Urgent Call for Action: The Debt Ceiling Dilemma

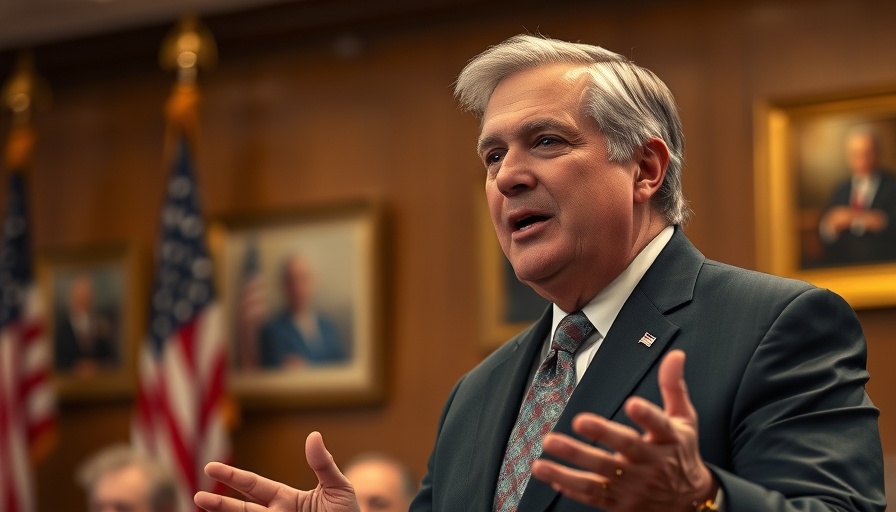

Treasury Secretary Scott Bessent recently issued a crucial warning that has significant implications for the U.S. economy. With bills looming and funds running dangerously low, the government could run out of money as early as August unless Congress steps in to raise or suspend the debt ceiling by mid-July. Bessent emphasized that failure to act could lead to devastating consequences for financial markets, businesses, and the country’s global standing. This dire situation serves as a reminder of the importance of fiscal responsibility and timely legislative action.

The Economic Ripple Effects of Budget Stalemates

Bessent's letter to House Speaker Mike Johnson highlights the urgency of the situation, recalling how past delays in raising the debt limit have led to turmoil in financial markets. Without swift action, not only could the U.S. default on its debts, but it might also undermine investor confidence—a crucial element of economic stability. When financial markets are uncertain, the impact reverberates through businesses and the average American, leading to a ripple effect that can increase borrowing costs and reduce economic growth.

Government Strategies: Navigating Extraordinary Measures

Since the debt limit was reinstated, the Treasury has been utilizing "extraordinary measures" to stay afloat financially. These measures include halting payments into various federal accounts, like worker pensions and disability funds. While these steps provide temporary relief, they can only last for a limited time before the government faces more significant challenges. Bessent’s recent actions underline the necessity for lawmakers to act decisively in the face of looming deadlines to avoid further financial strain.

Past Precedents and Political Challenges

The political landscape surrounding the debt ceiling remains fraught with challenges. Notably, former President Donald Trump’s previous calls for a debt limit increase during negotiations highlight the tensions within the Republican Party, which often grapples with such financial decisions. The interplay of political ideologies and economic necessity often complicates the process of reaching an agreement in Congress. Understanding these dynamics is crucial, as a bipartisan solution could avert fiscal disaster.

The Importance of Public Awareness and Engagement

In these critical times, public awareness and engagement become paramount. Many citizens may feel disconnected from discussions about the debt ceiling and its implications. However, as members of a democracy, it's vital for individuals to recognize their role in advocating for sound financial management and accountability among elected officials. Encouraging public dialogue about fiscal policies can lead to a more informed electorate and spur legislators into action.

In conclusion, the call for Congress to raise or suspend the debt ceiling is not just a bureaucratic necessity—it’s a crucial step toward preserving the nation’s economic health. Citizens must stay informed and active in discussions around these issues to promote financial stability in the U.S. economy. Let’s hope the lawmakers respond promptly to meet the challenge head-on.

Add Row

Add Row  Add

Add

Write A Comment